Getting the right insurance for your trucking business is critical and time-sensitive. If you’re an owner-operator or run a small fleet, you don’t want to spend days on paperwork or phone calls – you need a fast and affordable commercial truck insurance quote online so you can stay focused on the road. At the same time, that policy must be authority-ready, meaning it meets all legal requirements for new trucking businesses and can be activated immediately. This article will show you how to quickly get a commercial truck insurance quote online while still benefiting from personal agent support, competitive rates, and coverage that’s ready for your operating authority from day one.

Why Commercial Truck Insurance Is Non-Negotiable

Commercial truck insurance isn’t just a formality – it’s the law and your lifeline in an industry full of risks. Federal regulations require most interstate trucking companies to carry at least $750,000 in liability coverage, and many freight brokers mandate $1,000,000 in coverage before they’ll work with you. In other words, you must have proper insurance in place to operate legally and secure loads. Beyond legal requirements, a single accident involving a commercial truck can cause enormous damage. The right policy protects your livelihood by covering costly claims for injuries, cargo damage, and property damage that could otherwise bankrupt a small trucking business.

Bottom line: If you drive a commercial truck for business, you need insurance from the moment your wheels hit the highway. Adequate coverage not only keeps you compliant with regulations but also protects your assets and income in case the unexpected happens.

Fast and Easy: Getting a Truck Insurance Quote Online

One huge advantage of today’s digital world is how quickly you can get insurance quotes. You no longer have to schedule in-person appointments or wait days for a callback. Many leading insurers and brokers offer instant or near-instant quoting systems. For example, one major commercial insurance company notes that you can get a commercial truck insurance quote online in as little as 8 minutes.

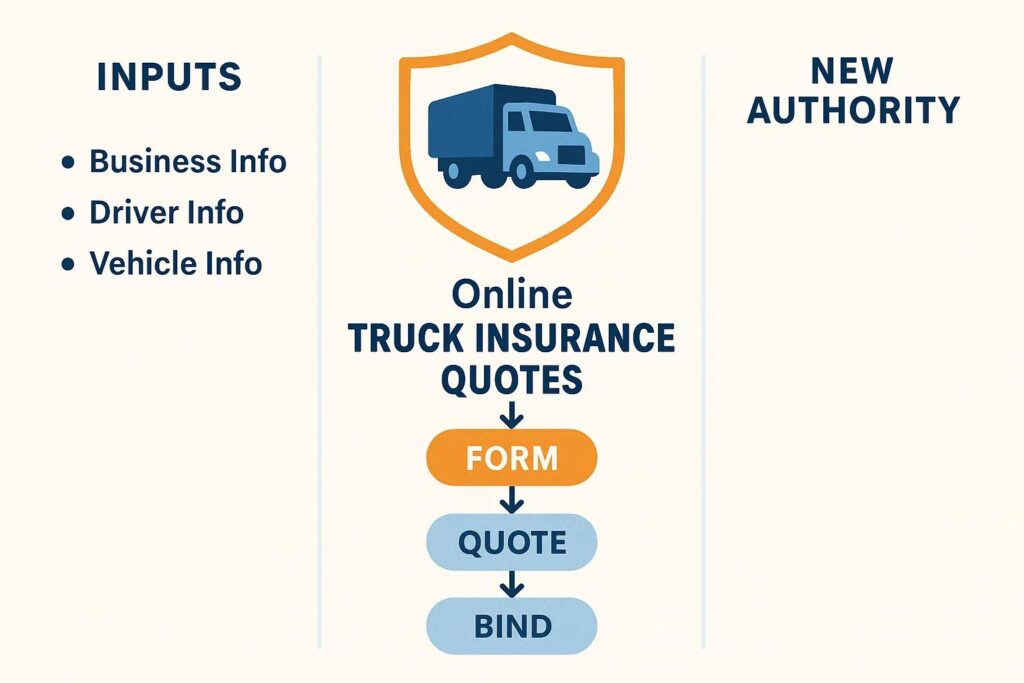

An online quote form will typically ask for some key details about your operation – things like your USDOT or MC number (if you have one), the type of truck(s) you need to insure, what you haul, your operating radius, and driver information. Make sure to have accurate info on hand, since these details will influence your rate. Once you hit “submit,” the system will crunch the numbers and provide an initial premium estimate. In many cases, this happens almost instantly or at least on the same day, allowing you to move forward without delay.

Instant commercial truck insurance quote: Some providers even advertise instant quotes, which means you get a bindable rate or quick indication of coverage within minutes. Keep in mind that the final policy may still require underwriting approval or additional information, but an online quote is the fastest way to see your options. This speed is crucial for truckers on tight schedules – for instance, if a new job pops up and you need to show proof of insurance immediately, an online quote and bind process can have you covered and on the road without missing a beat.

Online Convenience Plus Real Agent Support

Just because you start the process online doesn’t mean you’re on your own. In fact, the best truck insurance providers combine digital convenience with human expertise. With Driver Advantage, for example, you can input your information online and get a quick quote, but you also have the ability to speak with a real agent at any point for questions or advice. This hybrid approach gives you the best of both worlds – speed when you want it and personal guidance when you need it.

Why does speaking with an agent matter? Commercial trucking insurance can be complex, and your situation might be unique. A live agent can ensure your quote accounts for all the nuances of your business (from specialized equipment to unique coverage needs) and can help you avoid mistakes. They’ll make sure you’re not underinsured or overpaying for coverages you don’t need. This personal touch is something the big one-size-fits-all insurers often struggle with. In fact, while a large national insurer might offer quick online quotes and competitive prices, one common drawback is “less personalized service due to company size.”. There’s no substitute for having a knowledgeable local agent or broker who understands your industry and can act as your advocate.

Tip: An independent insurance agency can present you with multiple quotes from different carriers, not just one company’s offer. Unlike a captive company agent, an independent agent works with a variety of insurers. As a result, you can receive several quote options at once and choose the best fit. This means if one insurer’s quote isn’t ideal, your agent can pivot to another carrier. It’s a fast-track to finding the most suitable and affordable policy without you having to do all the legwork.

Affordable Commercial Trucking Insurance Quotes – How to Save

Cost is a major concern for anyone seeking commercial trucking insurance quotes. Premiums can range widely, so it pays to approach the process strategically. Here are key factors and tips to help you get an affordable commercial truck insurance quote without compromising vital coverage:

Compare Multiple Quotes: Don’t settle for the first quote you receive. Prices can vary thousands of dollars between insurers for the exact same truck and driver. Experts strongly advise shopping around – get quotes from several carriers to compare costs and terms. No single insurance company is always the cheapest, because each one evaluates risk differently based on your location, equipment, driving record, and more. By checking with multiple insurers (either on your own or through an independent agent), you increase your chances of finding a better rate for the same coverage.

Know What Affects Your Rate: Truck insurance pricing is highly individualized. Key factors include your driving history, vehicle type, cargo, operating radius, and even your base state. For instance, a safe driving record with no accidents or violations will generally lead to lower premiums, whereas a history of violations can drive rates up. Heavier or newer trucks cost more to insure (due to higher replacement costs), and long-haul operations often incur higher premiums than local routes because more miles mean more risk. Even the type of cargo you haul matters – hauling hazardous materials or high-value freight will typically raise your rates. By understanding these factors, you can see where you might improve (e.g. keeping a clean driving record) and also appreciate why one quote might be higher than another.

Look for Discounts and Safety Programs: Many insurers offer discounts that can significantly cut your costs. Common trucking insurance discounts include safe driver discounts, having safety equipment or telematics devices, bundling multiple policies, or paying your annual premium in full. For example, some companies give a break on rates if you use an electronic logging device (ELD) that monitors safe driving. Ask each insurer or your agent about available discounts. Taking a certified truck driver safety course or maintaining a good DOT safety score might also help you qualify for lower rates over time.

Consider Deductibles and Coverage Levels: Adjusting your deductible (the amount you pay out of pocket in a claim) is one way to control premiums. A higher deductible will lower your monthly premium – just be sure you could actually afford that deductible if a loss occurs. Also evaluate how much coverage you truly need. While you must meet legal minimums and contract requirements, you might not need every optional add-on. Conversely, don’t under-insure critical areas just to save a few bucks. An experienced agent can help balance affordability with adequate protection so you’re not left exposed in a major claim.

Flexible Payment Options (Monthly Payments)

One concern for many small businesses and new ventures is the up-front cost of insurance. A commercial truck policy can cost several thousand dollars per year, which is a lot to pay all at once. The good news is that most insurers offer monthly payment plans or financing to ease the burden. Typically, you might make a down payment (often around 20-25% of the annual premium) and then pay the rest in 8 to 10 monthly installments.

Some insurance providers even advertise affordable plans with no hefty up-front payment and no extra financing fees. If you qualify for such a program, it means you can start your policy with minimal money down and simply pay as you go each month. Be sure to ask about payment options when getting your quote. The ability to get truck insurance with monthly payments can make a big difference for a small trucking business or an owner-operator just getting started.

“Authority-Ready” Insurance for New Trucking Businesses (New Authority Quotes)

What do we mean by authority-ready insurance? If you’re a new trucking company or owner-operator with a new authority, it means your authority (MC number) has just been granted by the FMCSA and you’re starting operations under your own name. Insurance for new authorities comes with special challenges – and you need a policy that meets all regulatory requirements right away so your authority becomes active. Here’s what to consider if you’re seeking a truck insurance quote for a new authority:

Higher Risk = Higher Premiums (at first): As a new venture, you don’t have an established safety record or business history, so insurers generally view you as a higher risk. Some trucking insurance companies are even hesitant to take on new authorities; a few won’t write policies for carriers without at least a couple of years of experience on the books. Those that do insure first-year operators often charge astronomical rates to offset the unknown risk. It’s not personal – it’s an industry-wide issue where insurers have data showing new trucking businesses are more likely to have claims. Expect premiums on the higher side in your first year. For example, it’s not uncommon for a new single-truck owner-operator authority to pay well over $10,000 for the first year of insurance coverage. The good news is that if you run safely, you can see those rates come down over time as you build a positive track record.

Work with Specialists: Given the challenge above, it’s crucial to work with an insurance provider or agent experienced in new venture trucking. They will know which insurance companies are willing to insure new authorities at reasonable rates. Some insurance brokers specialize in new ventures and have access to multiple programs designed for new trucking companies. This is invaluable – instead of getting turned down or quoted sky-high prices by an insurer that isn’t “new authority friendly,” you can be matched with carriers who welcome new businesses. Comparing several quotes side by side is especially important for new authorities, as rates can vary widely. One service notes that bringing you quotes from three different trucking insurers who work with new ventures can ensure you’re getting the lowest possible price for the coverage you need.

Filings and Paperwork: To activate your motor carrier authority, the FMCSA requires proof that you have the required insurance in place. This usually means filing Form BMC-91 or BMC-91X (for liability coverage) and possibly other state filings if you operate intrastate. A truly “authority-ready” insurance quote isn’t just a price – it includes taking care of these filings for you. Any reputable insurer or agent will handle the federal and state insurance filings on your behalf as soon as you purchase the policy. For instance, Progressive Commercial notes that after you buy a truck policy and have your authority, they will electronically file the proof of insurance to the government for you. This is critical because your authority won’t go active until the FMCSA sees that filing. Driver Advantage understands the urgency here: we make sure that once you bind coverage, all the necessary filings are submitted immediately so you can start hauling loads without delay.

Tailored for Small Businesses: As a small business or solo owner-operator, you might also need guidance on selecting the right coverages to meet both legal requirements and customer contracts. “New authority” policies typically must include primary liability (often $1M coverage) and often cargo insurance at a limit that matches what shippers or brokers require (commonly $100k, but depends on what you haul). You’ll likely need physical damage coverage to protect your own truck if it’s financed or if you want to avoid paying out of pocket for repairs. A good agent will walk you through these and ensure your policy package is custom-built for your operation. Even if you’re just one truck starting out, you can get a policy that is robust enough to satisfy all obligations yet mindful of your budget constraints. At Driver Advantage, we don’t shy away from insuring new ventures – our team takes pride in helping new authorities get on the road with confidence and with the right insurance from day one.

Get Your Commercial Truck Insurance Quote Online Today

Every day you’re uninsured is a day your business is at risk. The good news is that securing a commercial truck insurance quote online is now faster and easier than ever. Whether you’re starting your own MC for the first time or renewing in your home region, check our states we serve section to explore state-specific requirements before you bind coverage.

With Driver Advantage, you get the efficiency of instant online quotes and the peace of mind that comes from working with a knowledgeable agent who understands trucking. Our goal is to help you secure fast, affordable, and authority-ready insurance so you can keep your wheels turning and your business earning.

Ready to protect your trucking business? It only takes a few minutes to get started. If you’re a new carrier, start with our how to get truck insurance for new authority guide before completing your online quote — it’ll help ensure your filings and limits are set up correctly.

Get your quote today and keep on trucking – safely and securely.